Your available balance is the amount you can currently move out of your Coinbase account, either by sending crypto or cashing out. It’s calculated by subtracting any funds on hold from your total account value.

Funds on hold

When you use a linked bank account (ACH) to buy crypto or add cash to your account balance, the funds are placed on hold and won’t be immediately available to send or cash out. Think of this like depositing a check to your bank account and having to wait for it to clear before you can remove the funds.

During the hold period, you can still sell or trade crypto that you bought with these funds, or you can use the funds to buy crypto. However, until the hold is removed, you won’t be able to cash the funds out or send any crypto bought with these funds from your Coinbase account. This is a standard Coinbase policy and, for fraud prevention purposes, we can't change the hold time.

Funds on hold will always be represented in local currency, regardless of whether you added cash or purchased crypto.

Any increase in the value of cryptocurrency does not affect your cashout availability.

Hold periods

Hold periods are based on many factors, such as account history, payment activity, and transaction history.

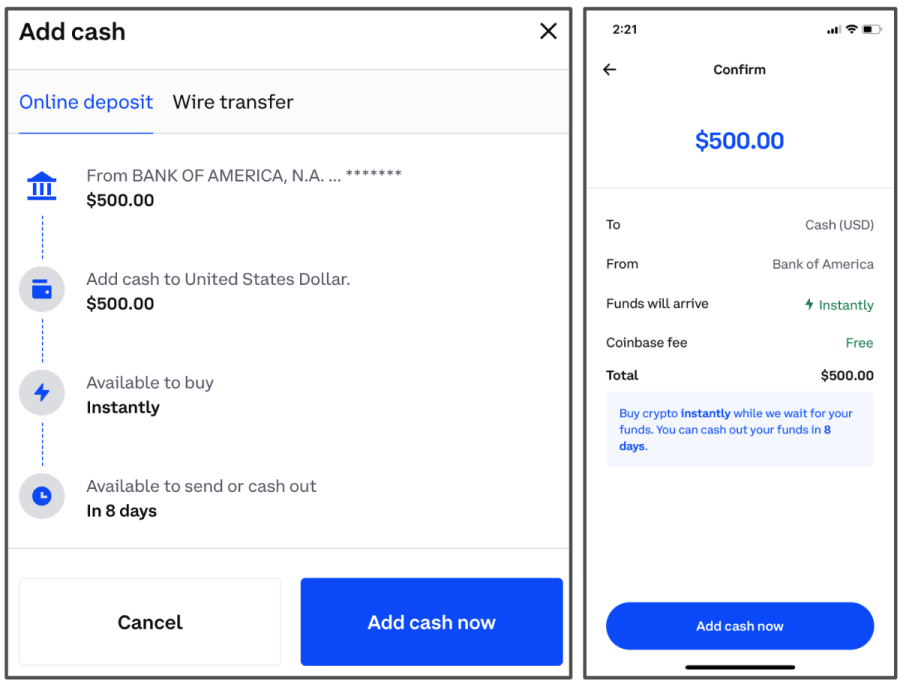

When adding cash, you’ll be advised prior to confirming the transaction when the funds will be available to move out of your account.

After your transaction completes, you’ll receive a confirmation email that says when funds will be available to move out of your account. You’ll receive another email when the funds are available.

Holds typically expire by 11:59 PM PST on the date listed. Coinbase Support cannot reduce the hold time.

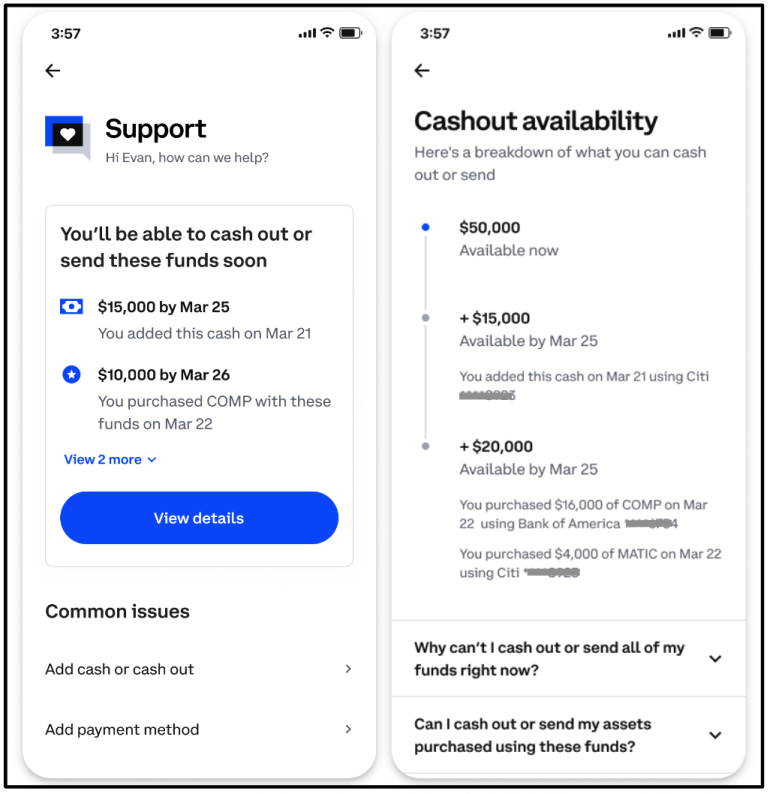

View Available balance or Cashout availability

If you have funds on hold, you can view details of your available balance and cashout availability from your account.

Mobile app: Tap the Menu icon in the upper left and then tap Support

Web browser: Select your profile picture in the upper right corner and select Get Support

Wire transfers and debit card purchases do not affect your availability to cash out but are subject to any existing holds on your Coinbase account.

Related article: