View positions and add cash

Cash is always deposited into your Coinbase Inc. (CBI) spot account. Cash will automatically be transferred to your Coinbase Financial Markets (CFM) futures account to satisfy margin requirements.

Follow the instructions below to add cash to your CBI spot account.

Mobile app

Sign in to your Coinbase app

.

.Tap

.

.Scroll down and tap your contract to view it.

Tap Make payment to make a payment.

Web browser

Sign in to Coinbase.com.

Select Portfolio on the left side of the screen.

View your futures positions on this page.

Select USD and Deposit Cash to add cash to your account.

Close futures positions

When a contract expires, we automatically close your open position at the exchange settlement price. You can also close your position before the contract expires (for example, you may want to close your position if you've reached your profit target, you want to prevent further losses, or you need to satisfy a margin requirement).

There are three ways to close your futures positions:

On the portfolio page, hover over a position and an “X” will appear. Once you click it, a button will appear to close your position.

Select your contract by clicking on it (for example, on the portfolio page) and a button will appear to close your position.

On the trade page, take the opposite position in the same futures contract you are currently holding in your account.

For example, to close an open long position in the BTC 23 Feb 24 contract, place an order to sell the same number of BTC 23 Feb 24 contracts. If you were short to begin with, go long the same number of contracts to close your position.

Change payment method

Linking a new bank account to your CBI spot account may take several days and bank payments take 3-5 days to process. You can use available funds from your USD cash balance.

You can only use a linked bank account or funds from your linked USD cash balance wallet to add cash or cash out.

Learn about adding funds to your USD cash balance.

If you’d like to link a bank account for adding cash or cashing out, you’ll need to first add your bank information and then verify the bank. Depending on your bank, verification can happen within minutes, or it may take several days.

To link a payment method

Go to Payment Methods (web) or select Settings > Payment Methods (mobile)

Select Add a payment method

Select the type of account you want to link

Follow the instructions to complete verification depending on the type of account being linked

Note: Coinbase Inc. does not accept physical checks or checks from bill pay services as a payment method to purchase cryptocurrency or to deposit funds into a user's cash balance. Any such checks received by Coinbase Inc. will be voided and destroyed.

Learn how to add a payment method.

Futures statements

Your Futures Statement will have five main sections:

Financial Summary - A summary of all balance totals including cash, margin requirements, realized profit and loss, unrealized profit and loss, fees, and commissions.

Futures / Options Confirmations - A summary of all trading activity on the statement date, including fees and commissions.

Purchase & Sale - A summary of any offsetting positions and the realized profit or loss.

Itemized Cash and Adjustment Activity - A summary of any cash movements or adjustments into, or out of, the account.

Futures / Options Open Positions - A summary of any open positions currently held on the account and any associated unrealized profit or loss.

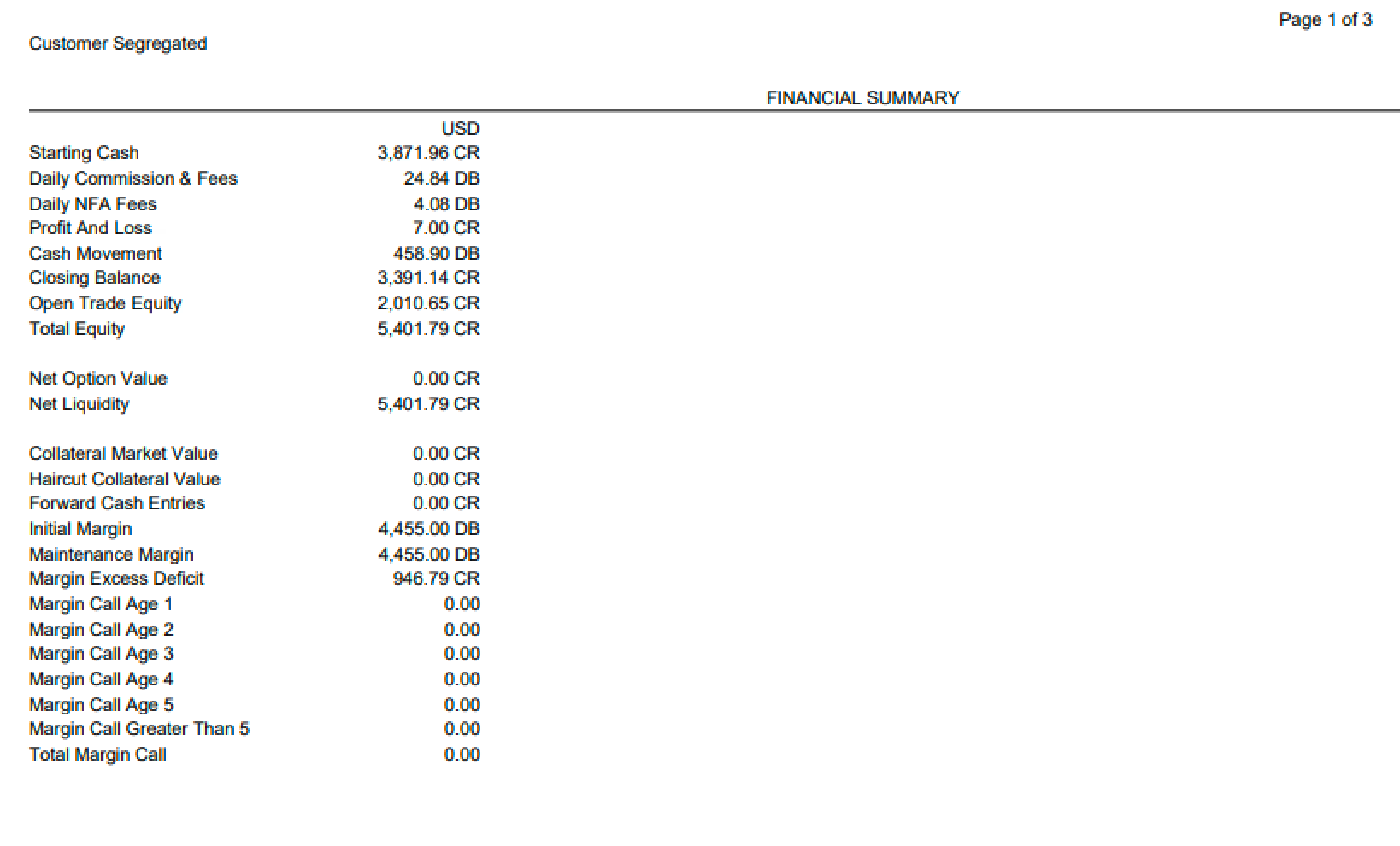

Section 1: Financial Summary

This section details all financial information for the Coinbase Financial Markets account. It will include totals for all cash balances, realized and unrealized profit and loss, fees, commissions, margin requirements, any current or aged margin calls, and the overall excess or deficit amount in the account.

Starting Cash - The cash balance carried over from the previous day’s closing balance

Daily Commissions & Fees - Total commissions and fees charged for trading activity

Daily NFA Fees - Total National Futures Association (NFA) fees charged for trading activity

Profit and Loss - Total realized profit or loss on any offsetting positions

Cash Movement - Aggregate cash movement into and out of the account

Closing Balance - The starting cash balance plus all fees, commissions, net profit or loss, and cash movement

Open Trade Equity - Total unrealized profit or loss on any open positions

Total Equity - The closing balance plus open trade equity

Net Option Value - The unrealized profit or loss of any open options contracts (options trading is not supported at this time)

Net Liquidity - Total equity plus net option value

Collateral Market Value - Market value of any non cash collateral pledged to cover initial margin requirements (only USD cash is supported at this time)

Haircut Market Value - Post haircut value of any non-cash collateral pledged to cover initial margin requirements

Initial Margin - The minimum deposit required for all open futures positions

Maintenance Margin - The exchange minimum deposit required, if applicable, for all open futures positions

Margin Excess Deficit - The overall excess or deficit in the account (total equity minus initial margin)

A margin sub-section for aged margin calls is also included. The aged margin days are defined as:

Margin Call Age 1 - The business day the position is opened and the account becomes undermargined (T)

Margin Call Age 2 - The first business day the margin call is issued (T+1)

Margin Call Age 3 - The first business day the margin call is outstanding (T+2)

Margin Call Age 4 - The second business day the margin call is outstanding (T+3)

Margin Call Age 5 - The third business day the margin call is outstanding (T+4)

Margin Call Greater Than 5 - The sum of all margin calls greater than or equal to four business days outstanding

Total Margin Call - The total of all outstanding margin calls

Section 2: Futures / Options Confirmations

This section outlines any and all trades that were executed on the statement date. It will include all relevant trade details including fees and commissions.

Trade Date - Trade date of the transaction

Buy/Sell - The quantity of contracts bought or sold

Delivery/Product - The delivery period and contract description of the product

Trade Price - The price at which the contracts were bought or sold

Ccy - The currency in which the product is denominated

Amount - Any relevant cash postings resulting from the transaction

Commission & Fees - The sum of all commissions and fees charged for the trade

NFA - The National Futures Association assessment fee

Section 3: Purchase and Sale

This section details any offsetting positions that have been closed out and profit or loss realized. It will show the specific buys that have been matched off against sells of the same delivery and product, and the resultant profit or loss will be shown in the amount column on the far right side of this section. All positions are offset using First In First Out (FIFO) methodology.

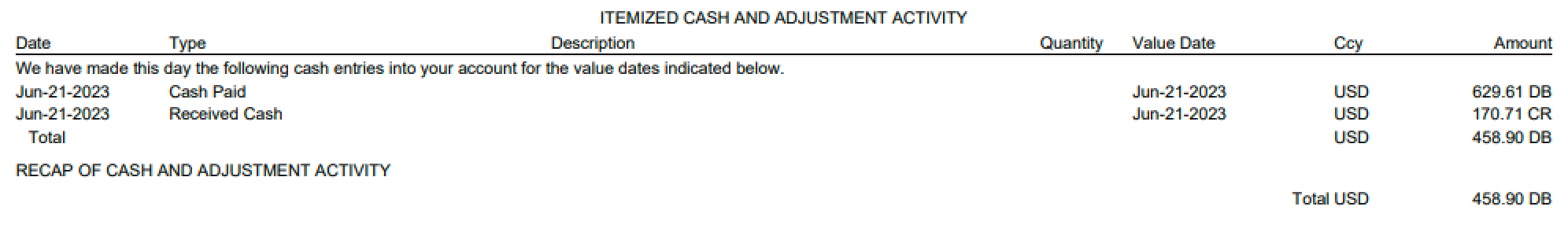

Section 4: Itemized Cash and Adjustment Activity

This section outlines any cash movement into or out of the account.

Date - The statement date

Type - The type of cash adjustment that was posted (typically either “Cash Paid” or “Cash Received”)

Description - An optional field that can be used to include any additional information with regards to the cash adjustment

Quantity - If the cash adjustment is posted in relation to a specific trade of position, the quantity will be included here

Value Date - The date the cash adjustment was posted (this could either be the same as the statement date or backdated to a date prior)

Ccy - The currency of the cash posting

Amount - The cash amount

Section 5: Futures / Options Open Positions

This section details the open positions held on the account and any unrealized profit or loss of those positions.

The layout is similar to Section 2 (Futures / Options Confirmations) with some exceptions noted below:

Amount - The unrealized profit or loss on an individual position level

Settlement - The settlement price used to calculate the mark-to-market value of each position

FLTD - The last trade date on which the contracts can be traded before they go to delivery