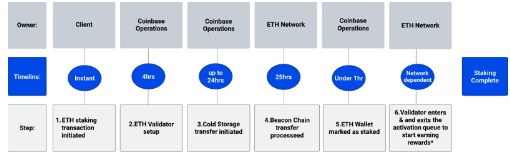

ETH staking transactions must go through an activation process before you start earning rewards. Rewards will only be earned once the full activation process is complete. Please note the time to complete this process is dependent on the network.

The following steps comprise the activation process:

*Note on step 6:

To ensure the security and stability of the network , the protocol requires newly staked ETH to enter/exit the activation queue. This process is network dependent and not in Coinbase’s control. The activation periods can range from hours to weeks or longer before earning ETH rewards. The status of ETH in the activation queue can be evaluated here*.

*Third-party website provided for information only. Coinbase hasn't verified and doesn't guarantee the accuracy of information provided.

Validators must be active for >= 256 epochs (~1 day) before they can exit. Once requested, validators will go through a protocol-level exit queue.

The time taken to process unstaking requests is determined by Ethereum protocol and demand. We anticipate the demand for unstaking on the network to be high soon after the upgrade and may take weeks to complete. Depending on demand, unstaking can take between hours, weeks or months to complete. Clients will be able to view an estimated time it may take to unstake prior to unstaking within the user interface. During the unstaking process you will continue to accrue validator and transaction rewards for your ETH.

When staking with multiple validators (more than 32 ETH), the unstake request will be done in Prime for the whole wallet but each validator will exit separately. This can be tracked in the View Validators page in Prime.

Lastly, following a validators exit, an additional 1 - 4 days may be required for the full withdrawal of unstaked assets.

Validator types that you can use to stake asset on Coinbase Prime:

Coinbase default dedicated validator: Yes

Coinbase Developer Platform dedicated validator: Yes

Delegation minimum requirement (Prime UI Min.): 32ETH, see ETH guide for details.

Staking maximum: 3200 ETH per wallet

Estimated rewards rate: Rewards rates vary - visit https://www.stakingrewards.com/cryptoassets* for current estimated reward rates.

Estimated reward payout:

Era | Validator rewards are distributed every 4 - 5 days after the activation period is complete. Rewards may not settle in a specified account for an additional duration depending on network conditions.

Era | Transaction rewards are distributed when a validator processes a transaction and are not distributed in a specified time frame.

Delegator reward compound: Not applicable

*Third-party website provided for information only. Coinbase hasn't verified and doesn't guarantee the accuracy of information, including minimum requirements, staking maximums, and reward rates, provided on www.stakingrewards.com

Bonding period: Dependent on network conditions

Unbonding period: Dependent on network conditions

Refer to the Staking & Unstaking section of this article for more details on the staking activation and unstaking processes.

Ability to stake when using the following entity:

Coinbase Custody Trust Company, LLC: Yes

Coinbase Custody International, Ltd.: Yes

Coinbase Germany GmBH: Yes

Coinbase, Inc. (Custodial Account only): Yes

Ability to unstake assets: Yes

Can you withdraw part of staked assets (or must you withdraw all): Must withdrawal all

Ability to change staking amounts: Yes, but you have manually re-stake new rewards (post-merge) and additional deposits in increments of 32 ETH

Ability to add new principal funds to a staked wallet: No

Partial amounts allowed: Yes, only in multiples of 32

Fees charged when using the following validator types:

Coinbase Default Dedicated validator: 10% Charged by Coinbase Prime. Note: validation services are diversified across multiple high-quality validator providers including Coinbase Developer Platform

Coinbase Developer Platform dedicated validator: Subscription, participatory, and service fee vary. Reach out to your Account Manager or Prime Operations team for more information

Note: please note that the fee is not automatically taken out of your ETH rewards but is invoiced on a monthly basis.

Consensus requirements: General consensus approvals required for all staking activities

What is the US tax treatment for ETH staking?

When you receive your liquid rewards in your Coinbase Prime account, Coinbase will consider rewards earned from staking ETH as taxable income and subject to any required tax information reporting. Subject to future guidance from the IRS, ETH staking rewards are considered income, just like any other kind of staking rewards.

Rewards: Both ETH staking transaction and validator rewards will be considered income when they are received, using the market price of ETH as of the date they are received.

Tax treatment for ETH staking outside of the US may differ based on your jurisdiction and regulations; please contact a qualified tax accountant for more information.

Related articles and sources: